Updated Hermès Birkin Values Research Study - July 2017

Published: July 11, 2017

Update of Original Comparison of Investment Opportunities Study.

In light of recent record-breaking sales involving Hermès Birkin handbags at auction in both Asia and Europe, along with increased interest and record sales on Baghunter, we have performed additional research to offer an update of our original study discussing investment opportunities. This update takes into account the occurrences over the past 18 months since our initial study was published and looks at whether the Birkin bag continues to offer a sound investment option, how it has compared to the S&P 500 and gold over this period and any other relevant factors which have occurred during this time.

Since the release of our original study in January 2016, the Hermès Birkin has smashed the world auction record several times. A few months before our study, a Hermès Fuchsia Birkin handbag sold at auction for a then record-setting $221,846. Just three months after we published our study, a 2008 Hermès Braise Shiny Porosus Crocodile Birkin bag with pave diamonds set the new world record, selling at auction for $298,000 in April 2016 by private appointment. Just two months later, in June 2016, a 30cm Himalayan Niloticus Crocodile Birkin with diamond-encrusted 18k gold hardware sold at auction for $300,168 to an anonymous buyer. Almost exactly a year later, at the beginning of June 2017, the record was broken again. This time a Hermès Himalayan Matte White Diamond Encrusted Niloticus Crocodile 30cm Birkin bag smashed the record, selling at auction for $377,000. This record-breaking sale was almost immediately followed up with another record at auction in London. A 2007 Shiny Bleu Marine Porosus Crocodile Hermès Birkin 35cm with 18k white gold and diamond hardware sold for approximately $196,540, setting an auction record for any handbag sold in Europe.

This consistent record-breaking for Hermès Birkin bags on the secondary market shows very clearly that the momentum of the Birkin is speeding up rather than slowing down.

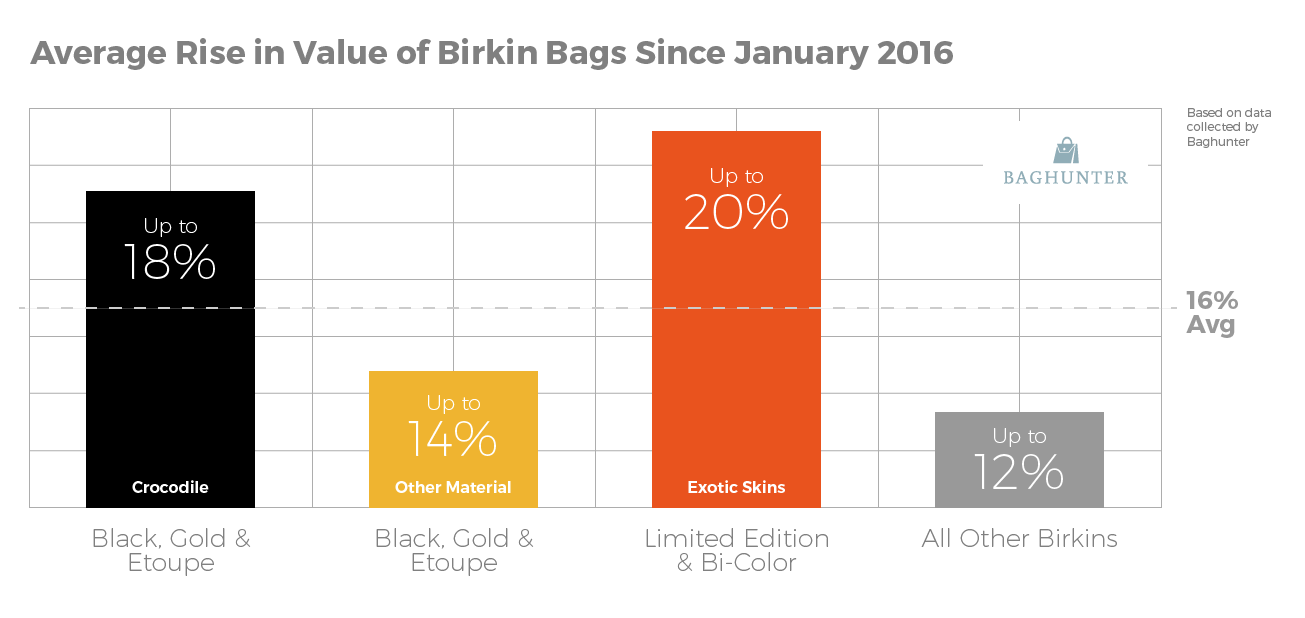

It is extremely likely that the current records for the Birkin will not last long and it would be no great surprise to see a new record set before the end of 2017. While it is possible to see these record-breaking sales of the top Birkin bags as one-offs, the trend of increasing values is present across the whole Birkin range. Since January 2016, Birkin value has risen by an average of 16% on the market. While the record-setting Birkin sales have made all the headlines, the entire Birkin market has continued to grow at an extraordinary pace. For example, a buyer who purchased an excellent or pristine condition Hermès Black Porosus Crocodile Birkin bag in January 2016 as an investment could expect between a 14 and 18 percent profit if they decided to sell now. More exotic bags such as bi-color or mixed exotic skin bags could fetch between 15 and 20 percent of their January 2016 value in today’s market. The average rise in value of Birkin bags since January 2016 is shown in the table below:

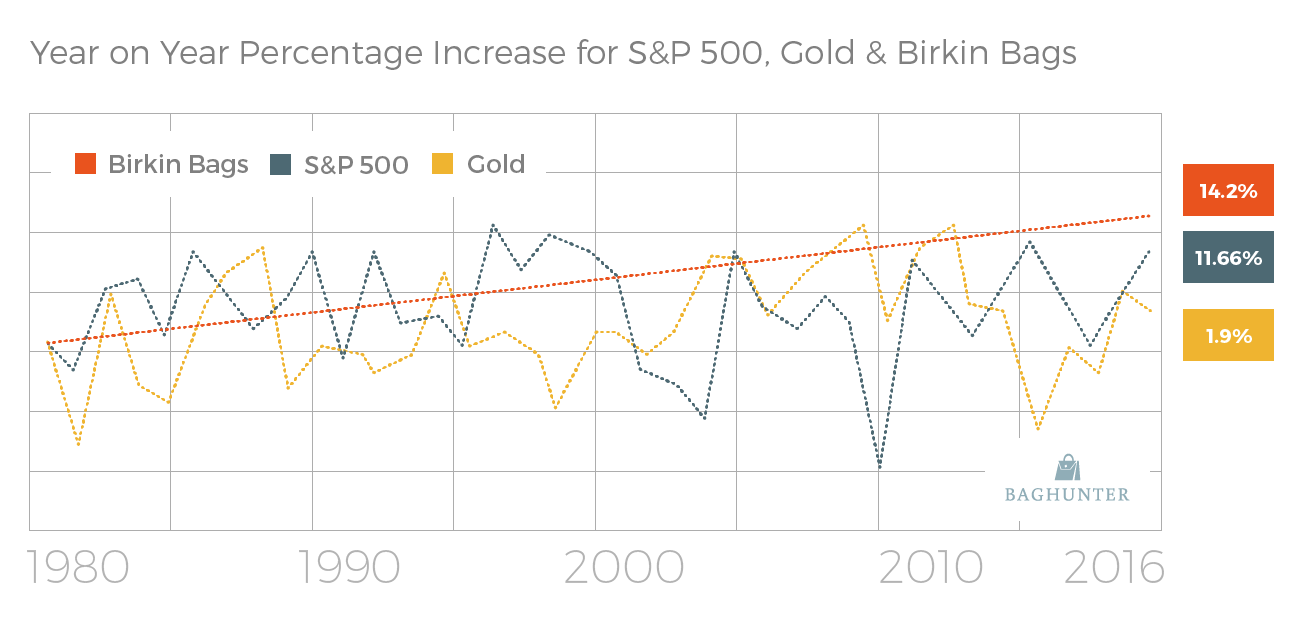

Our original study compared the investment opportunity of a Hermès Birkin bag with that of the S&P 500 and gold. To revisit that comparison, we can take a look at the performance of both the S&P 500 and gold markets over the last 18 months and see how they have performed in comparison to the Birkin bag. In 2016, the S&P 500 finished 2016 strongly and ended the year with exactly the average annual returns percentage between 1980 and 2016; 11.96% nominal. It has continued strong performance in 2017, with a mean return of 8.66% nominal as of June 2017. While the S&P 500 is enjoying a “bubble” at the moment, the market remains extremely vulnerable. One example of this vulnerability is the effect of the recent drop in oil prices which has caused the S&P 500 to close at a loss for several consecutive days in mid-June 2017. Even when oil prices gained slightly, the S&P 500 continued to post a loss. While it is possible for the index to recover, this shows how vulnerable the market is to fast and unforeseen negative growth.

Gold has experienced both highs and lows over the last 18 months, once again showing the volatile nature of these markets. An overall increase of 15.63% between January 2016 and June 2017 doesn’t tell the full story. During this time, gold has experienced the best month on month increase of 10.52% in February 2016 and the worst month on month performance of -5.77% in May 2016. Annual returns for gold in 2016 stood at just 3%, and annual returns between January 2017 and June 2017 are currently at 9%. However, gold has once again experienced a decline in June 2017, falling by 1.67%, and predictions about where it will end the year vary wildly. Once again, gold represents a high risk as an investment and is extremely vulnerable to a sharp decline.

(Image showing the rapid fluctuations in the S&P 500 and gold markets since 1980 in comparison to the steady growth in value of Birkin bags during the same time period. Graph shows the average year on year increase of all three data entries since 1980)

*S&P 500 and gold plotted using data from onlygold.com and macrotrends.net (See Works Cited)

While both the S&P 500 and gold have enjoyed positive growth over the last 18 months, they remain shaky and predictions about where they could end the year vary wildly from person to person. It is also interesting that both the S&P 500 and gold are widely thought to be in the midst of a “bubble” period, yet still do not outperform the Hermès Birkin regarding returns over the last 18 months. Add to that the unpredictability of both of these markets in comparison to the stability of the Birkin, and according to these figures the Hermès Birkin bag remains the safest and the least volatile investment of the three. While future predictions about the direction of the S&P 500 and gold can significantly vary depending on which expert is discussing the matter, the continuiously positive growth in value for the Hermès Birkin points in only one direction - up.

The Birkin is extremely likely to continue breaking records and increasing in value year on year regardless of the economic situation or other external influences which impact the other markets.

***Data for Birkin bags in this study is from information collected by Baghunter. The data is collected from the price printed on purchase receipts which accompany bags consigned and sold through the Baghunter platform and from sales figures on Baghunter. In cases of bags without purchase receipts, data has been gathered from customer quotations of purchase price along with the year of purchase, verified by the “blind stamp” located on the Birkin.***

Works Cited

Baghunter. “Hermès Birkin Values Research Study.”

https://baghunter.com/pages/hermes-birkin-values-research-study

Huen, Eustacia. “Inside the Hermès Birkin Bag That Sold for Record $298,000.”

www.forbes.com/sites/eustaciahuen...

Nicks, Denver. “This Purse Sold For $300,000 in a Record-Setting Auction.”

https://time.com/money/4352515/hermes-birkin-handbag-auction/

Luu, Christopher. “This is the Most Expensive Bag Ever Sold.”

https://www.refinery29.com/hermes-birking-christies-auction-world-record

Gibson Stoodley, Sheila. “Breaking Records: How High Can the Hermès Birkin Go?”

https://robbreport.com/style/accessories...

Waggoner, John. “Here’s why your clients probably didn’t beat the S&P 500 in 2016.”

https://www.investmentnews.com/heres-why-your-clients-probably-didnt-beat-the-sp-500-in-2016

Y Charts. “S&P 500 Total Return Annual”.

https://ycharts.com/indicators/sandp_500...

Imbert, Fred. “S&P closes lower after oil drops more than 2% again.”

https://www.cnbc.com/2017/06/21/us-stocks-oil-prices.html

Kingham, John. “S&P 500 Valuation and Projection: 2017 Q2.”

https://seekingalpha.com/article/4067041-s-and-p-500-valuation-projection-2017-q2

Decambre, Mark. “DOW, S&P 500 book 3rd straight loss, even as oil and health care rally.”

Bhayani, Rajesh. “Views differ on gold’s investment use after its low returns in past 5 years.”

Investing.com. “Gold Futures Historical Data.”

https://www.investing.com/commodities...

Becker, David. “Gold Price Prediction for June 20, 2017.”

https://www.fxempire.com/forecasts...

OnlyGold.com. "Historical Gold Prices".

http://onlygold.com/Info/Historical-Gold-Prices.asp

MacroTrends.com. "S&P 500 Historical Annual Returns".

https://www.macrotrends.net/2526/sp-500-historical-annual-returns

*S&P 500 and gold plotted using data from onlygold.com and macrotrends.net (See Works Cited)

*S&P 500 and gold plotted using data from onlygold.com and macrotrends.net (See Works Cited)